For eCommerce entrepreneurs, securing capital is often the key to unlocking growth opportunities. Shopify Capital simplifies the funding process by offering quick, data-driven financing solutions tailored to Shopify merchants.

With business loans and merchant cash advances ranging from $200 to $2 million, Shopify Capital has already provided over $5.1 billion in funding. Unlike traditional lenders, it assesses eligibility based on store performance rather than credit scores, making it a hassle-free option for online sellers.

Let’s dive into everything you need to know about Shopify Capital and how it can help scale your business.

Shopify Capital – TL;DR

Before I give you a detailed breakdown of Shopify Capital’s features, let’s understand the fundamental aspects that make this financing solution unique.

This overview provides a snapshot of Shopify Capital’s key characteristics, highlighting everything from funding options to geographical availability and processing requirements.

| Feature | Description |

|---|---|

| Funding Types | Merchant Cash Advances, Business Loans |

| Funding Range | $200 – $2 million |

| Total Funded | $5.1B+ to Shopify merchants |

| Repayment | Percentage of daily sales |

| Processing Time | 2-5 business days after approval |

| Availability | US, Canada, UK, Australia |

| Credit Check | No hard credit checks are required |

| Equity Required | 0% (no stake taken) |

Let’s proceed further and understand further details about this Shopify service:

What Is Shopify Capital?

For e-commerce entrepreneurs struggling with traditional bank loans or seeking faster funding options, Shopify Capital emerges as a game-changing financing solution.

But what exactly makes it different from typical business loans, and how can it fuel your business growth? Let’s break down its unique approach to both small and large-scale business funding.

1. Small Business Funding

Think of Shopify Capital’s small business funding as your springboard to growth. Starting at just $200, this financing option breaks away from conventional lending barriers.

For a business that is looking to stock up on that bestselling product, test new marketing channels, or simply need working capital for day-to-day operations, the funding process is refreshingly straightforward.

Unlike traditional lenders who scrutinize your credit score, Shopify evaluates what really matters – your store’s performance metrics, sales history, and growth potential.

Small businesses that used Shopify Capital:

- Chomp

- Ripton

- The Public Pet

- Black Optical

- Ilthy

2. Large Business Funding

For established merchants ready to take their success to the next level, Shopify Capital’s large business funding provides substantial capital injections up to $2 million. But, this isn’t just about having access to more money; it’s about scaling strategically.

When planning to expand into new markets, launch a game-changing product line, or invest in sophisticated marketing campaigns, this funding tier maintains the same flexible structure while accommodating your bigger ambitions.

The beauty lies in its scalability – as your business grows, your funding capacity can grow with it.

Large businesses that used Shopify Capital:

- Turntable Lab

- Nomad

- Tecovas

- Harvey

- Pashion

- Shock Surplus

Comparison With Traditional Loans

When comparing Shopify Capital to traditional financing options in 2025, the differences become strikingly clear:

| Feature | Shopify Capital | Traditional Loans |

|---|---|---|

| Application Process | Data-driven, automated approvals based on store performance | Mountains of paperwork, business plans, and financial statements |

| Credit Requirements | Store performance matters more than personal credit | Strict credit score thresholds that can exclude promising businesses |

| Approval Time | Lightning-fast decisions in days | Weeks or months of uncertainty |

| Repayment Structure | Flexible payments that scale with your sales | Rigid monthly payments regardless of business performance |

| Collateral | No assets needed to secure funding | Usually requires business or personal assets as security |

| Integration | Seamlessly built into your existing Shopify workflow | Separate systems create an additional administrative burden |

While traditional banks cling to outdated lending practices, Shopify Capital has revolutionized business financing for the digital age.

Think of it as modern financing that matches the speed of e-commerce. While traditional lenders are still shuffling paperwork, you could be reinvesting capital into your next growth opportunity.

Who Is Shopify Capital For? Why Should You Consider Shopify Capital Funding?

Moving ahead to understand who is this service structured for, ideally, Shopify says it’s for small as well as large-scale businesses, but for whom exactly? Shopify Capital is specifically designed for:

- Active Shopify merchants with a consistent sales history

- Businesses needing quick access to working capital

- Entrepreneurs looking to scale their operations

- Stores with strong sales but limited traditional financing options

- Merchants seeking flexible repayment structures

If you tick any one of the above pointers, you can consider Shopify Capital when you need to:

- Purchase inventory in bulk

- Launch marketing campaigns

- Expand to new markets

- Upgrade technology infrastructure

- Bridge seasonal cash flow gaps

- Fund rapid growth opportunities

Shopify Capital Eligibility Criteria

To understand the eligibility criteria for a Shopify Capital loan, here’s a breakdown of the essential qualifications and requirements you’ll need to meet before applying for a business loan or merchant cash advance.

- Geographic Location

- Operating in eligible countries (US, Canada, UK, Australia)

- Specific state restrictions apply for US merchants

- Business Performance

- Minimum 90 days of active selling on Shopify

- Consistent sales history

- Low-risk business profile

- Platform Requirements

- Active Shopify Payments or approved payment provider

- Compliance with Shopify’s Terms of Service

- Good standing account status

- Business Banking

- Connected business bank account

- Verified business information

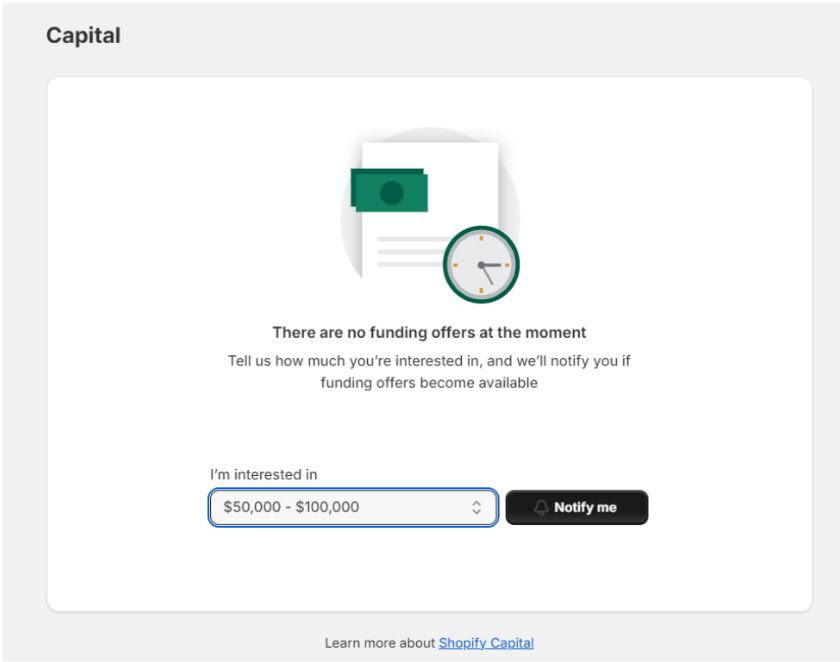

How To Apply For a Shopify Capital Loan?

Merchants must meet a few requirements to qualify for Shopify Capital. Although the application process is invitational, merchants can also apply on their own.

Use this link to check your eligibility status and select an amount you wish to get a loan for.

How Does Shopify Capital Work?

Shopify Capital delivers funding through business loans in the United States as a lump sum payment with a straightforward application and repayment structure. Here’s exactly how it works:

Application Process

- Access funding options directly through your Shopify admin’s Finance page

- Review three funding options, each with different terms based on the loan amount and repayment percentage

- Submit application with minimal paperwork and no hard credit checks

- Receive decision typically within 1-3 business days

- Get funds deposited directly into your business bank account upon approval

Shopify Capital Repayment

The key highlight of Shopify Capital’s repayment system lies in its daily payment structure, where a fixed percentage is automatically deducted from your total daily sales.

This includes revenue from all sources, including your online store, physical locations, and various sales channels and apps.

A key advantage is the 18-month maximum repayment term, structured with two critical milestones to keep your payments on track.

- You’ll need to repay 30% of the total amount within the first 6 months and

- 60% by the 12-month mark, ensuring steady progress toward loan completion.

What makes this system particularly merchant-friendly is its flexibility – on days without sales, you won’t make any payments. This aligns perfectly with business fluctuations, ensuring repayment never strains your cash flow during slower periods.

Renewing Capital

Shopify’s renewal process demonstrates its commitment to supporting continuous business growth.

You don’t have to wait until your current loan is fully repaid to access additional funding – new options appear in your admin dashboard as soon as you’re eligible for more capital. The renewal process maintains the same user-friendly approach as your initial funding.

Through your dashboard, you can easily monitor your loan details, track transactions, and manage multiple funding options, making it simple to keep your business well-funded as it grows.

What If You Fail To Repay Shopify Capital Loan Amount?

If your Shopify Capital loan repayments fail or fall behind schedule, you could default on your loan agreement. While Shopify won’t attempt to debit failed daily payments again, you can remedy the situation.

You can either wait for the next day’s automatic repayment or manually pay to cover the shortfall and keep your loan in good standing.

Shopify Capital Reviews

Here’s what actual brands that used the Shopify Capital service have to share about their experience:

- Hell Babes

“We’ve taken eight rounds of Shopify Capital. Repayments seamlessly integrate into our daily revenue” – Jessica Wise, CEO

- The Public Pet

“With Shopify Capital, my revenue increased by 40-50%—a direct result of expanding our inventory with new products.” – Jordan Lee, Owner

- Black Optical

“We used Shopify Capital to experiment with ads. It gave us the confidence to expand our digital eyewear presence.” – Gary Black, Founder & President

Is Shopify Capital Worth It?

Shopify Capital presents a compelling option for merchants already operating on the platform who need quick access to capital without traditional lending requirements. The service shines in several areas:

Shopify Capital Pros:

- Seamless platform integration

- Quick funding access

- No credit checks

- Flexible repayment structure

- No collateral required

Shopify Capital Cons:

- Invitation-only availability

- Potentially higher costs than traditional financing

- Platform dependency

- Limited transparency in approval criteria

Related Shopify Reads:

Conclusion: Shopify Capital Provides Better Loan Options

Shopify Capital represents a modern approach to business financing, leveraging platform data to provide accessible funding solutions.

While the invitation-only model and platform dependency may limit access, the service offers significant advantages for qualified merchants, including quick funding, flexible repayment terms, and seamless integration with existing operations.

Ready to explore your funding options to scale your business? Check your Shopify admin panel to see if you’re eligible for Shopify Capital!

FAQs

Shopify Capital provides business loans and merchant cash advances to Shopify merchants based on their store performance rather than credit scores.

You can receive between $200 and $2 million, depending on your store’s sales history and performance.

To be eligible, you must be an active Shopify merchant for at least 90 days, have a consistent sales history, and operate in the US, Canada, UK, or Australia.

No, Shopify Capital does not conduct hard credit checks. Your store’s performance determines your eligibility.

Once approved, funds are typically deposited into your business account within 2-5 business days.