Quick commerce (q-commerce) has quickly become a major player in the global retail industry, revolutionizing how people shop for everyday essentials. This ultra-fast delivery model, offering groceries and necessities within just 15 to 30 minutes, has seen rapid growth in recent years.

By 2024, it’s estimated that 597.3 million people worldwide will be using quick commerce, a sharp increase from 511.8 million in 2023, reflecting a 19.7% growth.

This shift toward faster, more convenient shopping has fueled the rise of quick commerce. For many consumers, these services have become indispensable, with a growing number relying on them for regular grocery shopping.

This article covers the latest statistics on Quick commerce, including the number of users, market size, market share, industry trends, consumer behavior, and more.

Quick Commerce Statistics 2025: Top Picks

- 597.3 million people worldwide are estimated to use quick commerce as of 2024.

- Approximately 56.1 million people in the United States are expected to use quick commerce services in 2024.

- There are about 200 dark stores in the U.S.

- The global quick commerce market is expected to reach $170.8 billion in 2024.

- The U.S. quick commerce market is expected to generate $56.52 billion in 2024.

- Zepto is the leading quick commerce app in 2024, with 27.7 million downloads worldwide.

- Quick commerce sales in India have grown by 280% in the last two years.

- India currently has a total of 1,290 dark stores.

How Many People Use Quick Commerce?

597.3 million people worldwide are estimated to use quick commerce worldwide as of 2024.

This marks a notable increase from 511.8 million users in 2023, reflecting a growth of 16.70%.

Looking ahead, the number of quick commerce users worldwide is anticipated to reach 788.6 million by 2027.

The following table displays the number of quick commerce users worldwide by year:

| Year | Number of Quick Commerce Users Worldwide |

|---|---|

| 2027* | 788.6 million |

| 2026* | 739.5 million |

| 2025* | 675.6 million |

| 2024* | 597.3 million |

| 2023 | 511.8 million |

| 2022 | 427.7 million |

| 2021 | 388.4 million |

| 2020 | 284.3 million |

| 2019 | 194.6 million |

| 2018 | 153.7 million |

| 2017 | 125 million |

*- estimated numbers.

Source: Statista

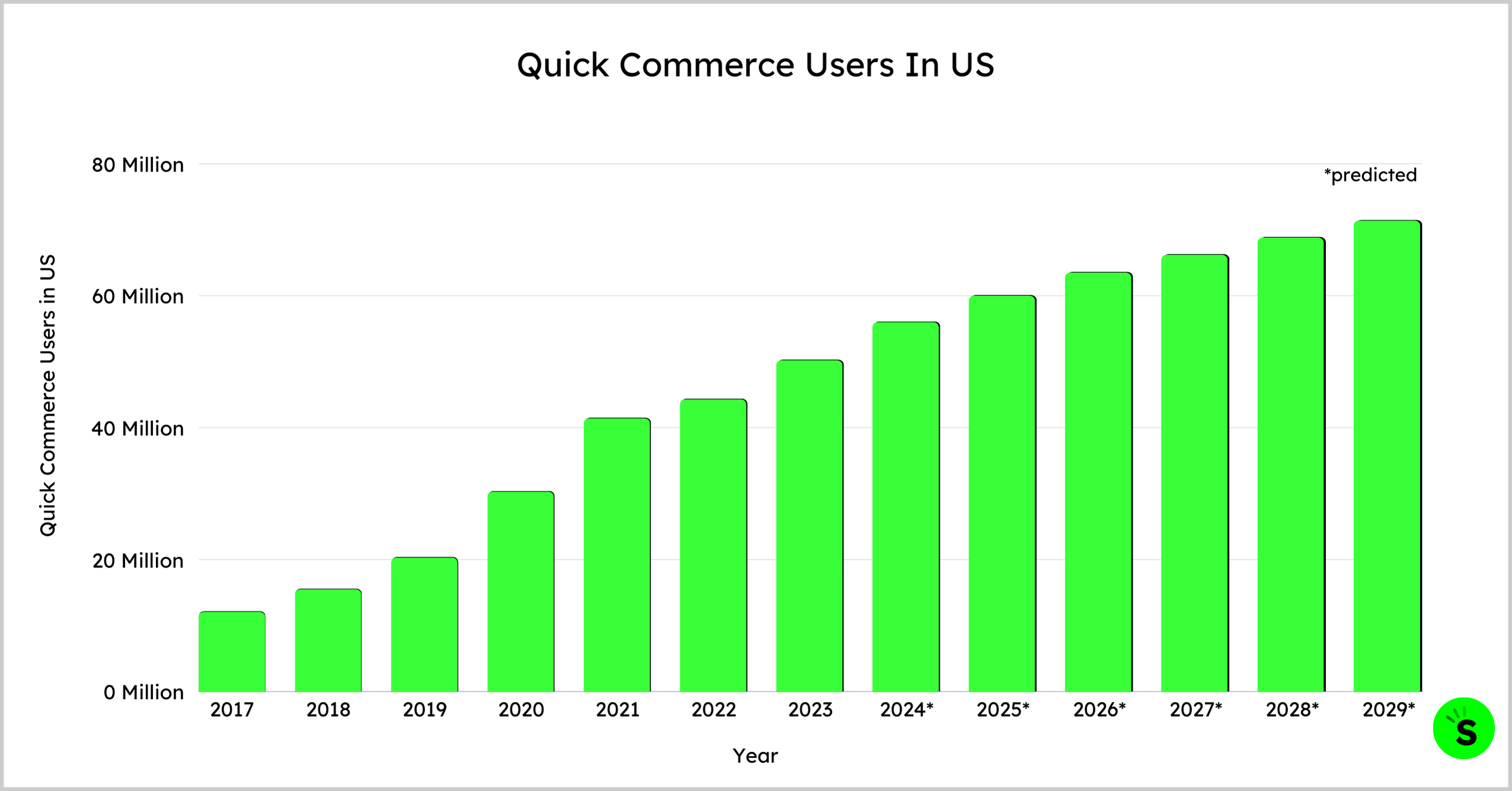

An estimated 56.1 million people in the United States are using Quick Commerce services in 2024.

This marks a growth of 5.8 million users compared to 2023 when 50.3 million people relied on these services.

Looking ahead, the Quick Commerce market is projected to expand even further, with the number of users expected to reach 71.5 million by the end of 2029.

The following table displays the number of Quick Commerce users by year:

| Year | Quick Commerce Users in US |

|---|---|

| 2017 | 12.2 million |

| 2018 | 15.6 million |

| 2019 | 20.4 million |

| 2020 | 30.4 million |

| 2021 | 41.5 million |

| 2022 | 44.4 million |

| 2023 | 50.3 million |

| 2024* | 56.1 million |

| 2025* | 60.1 million |

| 2026* | 63.6 million |

| 2027* | 66.3 million |

| 2028* | 68.9 million |

| 2029* | 71.5 million |

*-estimated values

Source: Statista

How Many Dark Stores Are There?

There are around 200 dark stores in the United States.

As of 2022, there were approximately 200 dark stores in the United States. By comparison, China has around 2000 dark stores, highlighting a significant difference in scale.

Dark stores are specially designed for online order fulfillment, strategically located near customers to enable quick deliveries. They’re called “dark” because they aren’t open to regular shoppers — instead, they function exclusively for pickups and operational purposes.

Source: Predik

Global Quick Commerce Market

The global Quick Commerce market is estimated to reach $170.8 billion in 2024.

Looking ahead, revenue in this sector is expected to grow at a steady compound annual growth rate (CAGR) of 9.24% from 2024 to 2029, bringing the market volume to an anticipated $265.7 billion by the end of this period.

This growth reflects the increasing adoption of quick commerce services as consumers shift towards faster, more convenient shopping experiences.

Besides, China is estimated to be the largest Quick Commerce market worldwide, generating revenue of $80.84 billion in 2024.

Source: Statista

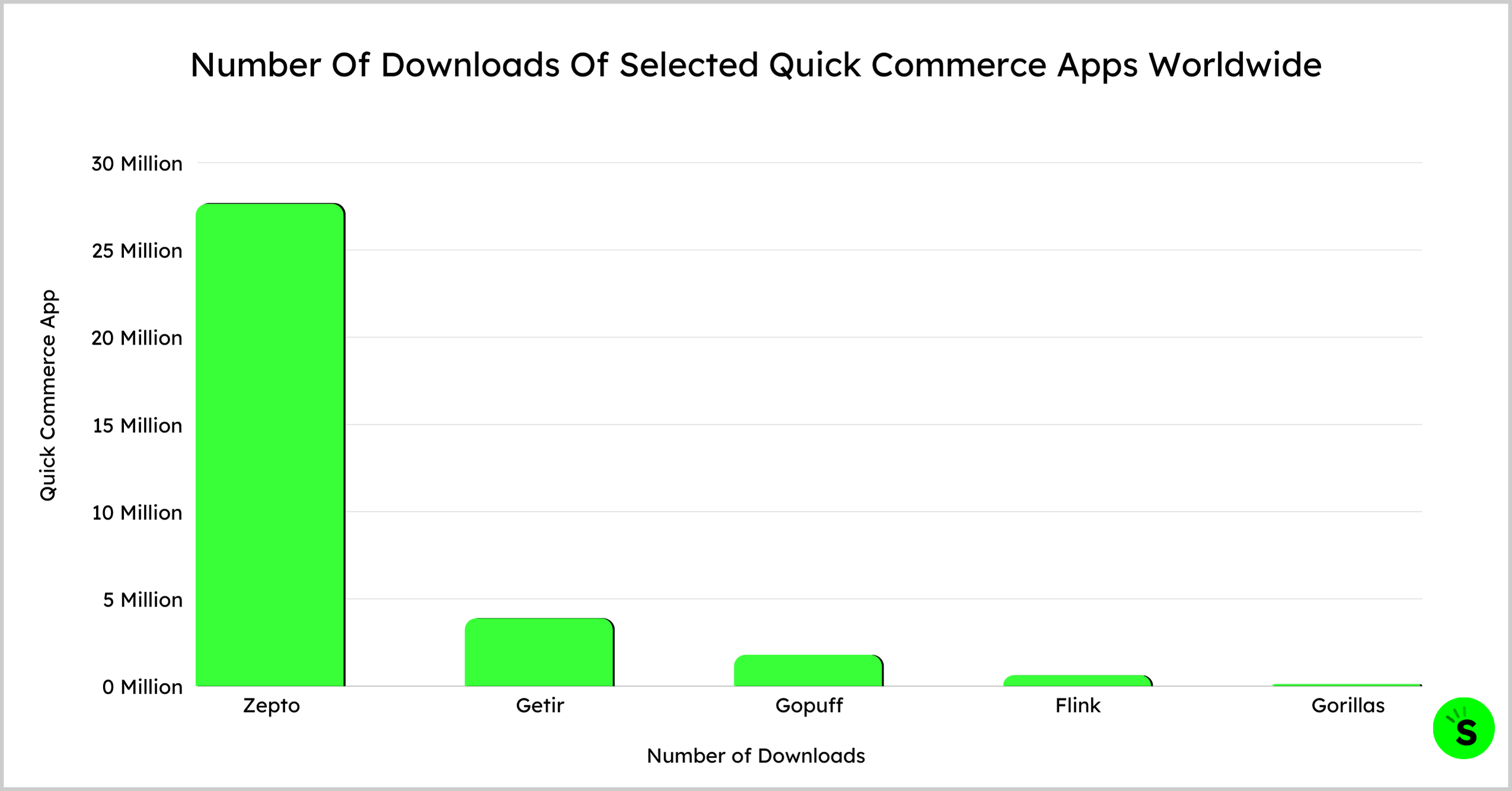

In 2024, Zepto leads with 27.7 million downloads worldwide, making it the top app in quick commerce.

Getir follows with 3.9 million downloads, showing a strong presence but far behind Zepto’s user acquisition. Gopuff and Flink follow with 1.8 million and 0.63 million downloads, respectively, showing a smaller but still significant presence in the quick commerce market.

Conversely, Gorillas has the fewest downloads, with just 0.12 million, indicating a more limited reach than its competitors.

The following table displays the number of downloads of selected quick commerce apps worldwide:

| Quick Commerce App | Number of Downloads |

|---|---|

| Zepto | 27.7 million |

| Getir | 3.9 million |

| Gopuff | 1.8 million |

| Flink | 0.63 million |

| Gorillas | 0.12 million |

Source: Statista

Quick Commerce Market In The United States

The Quick Commerce market in the United States is estimated to reach a revenue of $56.52 billion in 2024.

Comparatively, the market was valued at 47.92 billion in 2023.

Further, the quick commerce market in the United States is estimated to reach $81.91 billion in 2029 after growing at a CAGR of 7.70% between 2024 and 2029.

The following table displays the Quick Commerce market size in the United States by year:

| Year | Quick Commerce Market Size United States ($) |

|---|---|

| 2017 | 5.61 billion |

| 2018 | 8.02 billion |

| 2019 | 11.86 billion |

| 2020 | 22.99 billion |

| 2021 | 38.18 billion |

| 2022 | 39.89 billion |

| 2023 | 47.92 billion |

| 2024* | 56.52 billion |

| 2025* | 62.63 billion |

| 2026* | 68.35 billion |

| 2027* | 72.74 billion |

| 2028* | 77.26 billion |

| 2029* | 81.91 billion |

*-estimated values

Source: Statista

Walmart dominates the U.S. quick commerce market, with 53% of shoppers turning to them for groceries, beverages, or ready-made meal kits online over the past year.

The retail giant’s success is driven by its vast logistics network and widespread physical presence, allowing it to serve 90% of the U.S. population within just 10 minutes.

Amazon secures the second spot, with 42% of users choosing it for online grocery shopping in the past year.

Costco takes third place, with 26% of shoppers buying groceries online through its platform. The platform continues strengthening its market position by blending its brick-and-mortar presence with improved digital offerings.

Here is a table displaying the most used Quick Commerce providers in the United States.

| Quick Commerce Provider | Share of US Consumers |

|---|---|

| Walmart | 53% |

| Amazon | 42% |

| Costco | 26% |

| Aldi | 21% |

| Instacart | 21% |

| Blue Apron | 15% |

| Burpy | 11% |

| HelloFresh | 11% |

| Deliv | 11% |

| EveryPlate | 11% |

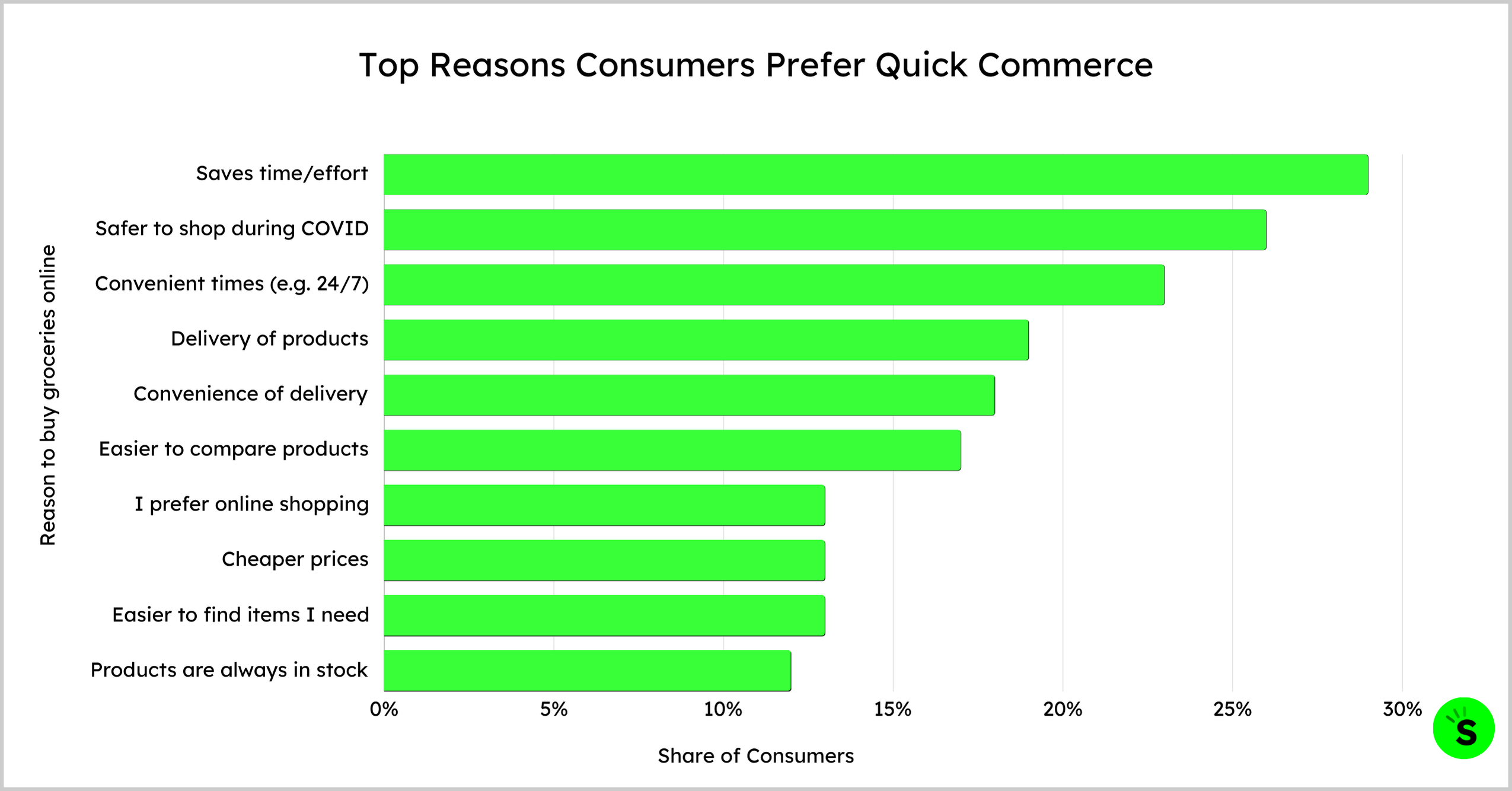

29% of US consumers preferred buying Groceries online as it saved effort and time.

Meanwhile, 23% of consumers value the flexibility of shopping at convenient times, such as 24/7 availability. Another major reason consumers cited to purchase groceries online was the convenience of delivery.

This highlights that the primary appeal of online grocery shopping lies in saving time, convenience, and delivery options. Secondary motivators include safety, price competitiveness, and product availability.

The following table displays the top reasons consumers prefer Quick Commerce as of 2022:

| Reason To Buy Groceries Online | Share of Consumers |

|---|---|

| Saves time/effort | 29% |

| Safer to shop during COVID | 26% |

| Convenient times (e.g. 24/7) | 23% |

| Delivery of products | 19% |

| Convenience of delivery | 18% |

| Easier to compare products | 17% |

| I prefer online shopping | 13% |

| Cheaper prices | 13% |

| Easier to find items I need | 13% |

| Products are always in stock | 12% |

Source: McKinsey

Current State of Quick Commerce in the United States

In the last two years, $800 million was poured into quick commerce companies in New York City alone. The pandemic was a major driving force behind this surge, accelerating the sector’s growth and demand. However, as lockdowns have ended and shoppers have returned to in-store visits, the quick commerce industry is undergoing a rapid transformation.

Some companies have struggled to keep up in the post-pandemic environment:

- Fridge No More shut down in March 2024.

- After just one year of operations, Buyk closed its doors around the same time.

- Jokr, which raised $430 million in venture capital, pulled out of the U.S. in June 2024, having lost $12 million in just six months — about $159 per order.

On the other hand, more established players are adjusting and evolving to stay relevant:

- Instacart, already a leader in same-day grocery delivery, has entered the rapid delivery space, aiming to fulfill orders in just 15 minutes. Despite this innovation, the company had to cut its valuation by 40% to $24 billion in May 2024.

- Gopuff, valued at $15 billion in 2021, rose to $40 billion in January 2024. However, by March 2024, its valuation returned to $15 billion after its planned IPO was canceled. Gopuff also reduced its workforce by over 10% through layoffs in 2022 and closed several dark stores. The company’s founders are now focusing on increasing investments in revenue-generating initiatives, including commerce integrations and Gopuff Ads.

- Other notable players like Uber Eats and Deliveroo are not yet profitable but continue to remain active in the market. They are trying to sustain their positions by partnering with retailers and expanding their advertising platforms.

- Flink, one of the rapid-grocery startups, raised $150 million at a nearly $1 billion valuation. Despite the challenges faced by the industry, Flink stands out as a survivor. However, like other companies, its current valuation of $1 billion is significantly lower than the $5 billion it was rumored to be worth in May 2022 following large investments from DoorDash and Carrefour.

Source: DataImpact, eMarketer.

Quick Commerce Market Size In India

The Indian Quick Commerce market is estimated to be valued at $3.35 billion as of 2024.

India is one of the fastest-growing quick commerce markets worldwide. Between 2024 and 2029, the market is estimated to grow at a CAGR of 24.33% and reach $9.95 billion.

Further, the number of quick commerce users in India is estimated to reach 60.6 million by 2029. The current user penetration of quick commerce in India is 1.8% and is projected to reach 4% by 2029.

Currently, the Indian Quick Commerce market is the fourth largest quick commerce market worldwide after China, the United States, and Japan. However, in 2025, India is estimated to overtake Japan and become the third-largest quick commerce market worldwide.

Source: Statista

India’s quick commerce sales skyrocketed by 280% over the past two years.

The Gross Merchandise Value (GMV) of the quick commerce sector grew from $0.5 billion in FY22 to an impressive $3.3 billion in FY24, highlighting the sector’s rapid expansion.

While India’s overall e-commerce market is growing at a steady annual rate of 14%, quick commerce is outpacing it significantly, with an extraordinary annual growth rate of 73% during FY 2023-24.

Source: Economic Times

India currently has 1,290 dark stores in total.

Swiggy Instamart leads the pack with 500 stores, demonstrating its strong presence and commitment to quick deliveries across the country.

Blinkit comes in second, with 450 dark stores, reflecting a solid network, though it’s slightly behind Swiggy Instamart in terms of store count.

Zepto ranks third, with 340 dark stores. While it has fewer stores than the other two, it continues to expand and holds a significant market share.

The following table displays the distribution of Dark Stores in India by Quick commerce providers:

| Quick Commerce Providers | Number of Dark Stores |

|---|---|

| Swiggy Instamart | 500 |

| Blinkit | 450 |

| Zepto | 340 |

Source: Statista.

Quick Commerce Market Share India

Zomato Blinkit leads India’s quick commerce market with a 40% market share as of January 2024.

This marks a consistent performance, as Blinkit maintained its 40% share in both March 2023 and January 2024, showcasing its stable market position.

In contrast, Swiggy-Instamart has seen a steady decline, dropping from 52% in March 2022 to 36% in March 2023 and further down to 32% by January 2024.

On the other hand, Zepto has shown remarkable growth, doubling its market share over two years — rising from 15% in March 2022 to 24% in March 2023 and then climbing to 28% by January 2024.

The following table displays the Quick Commerce market share breakdown in India:

| Year | Zomato-Blinkit | Swiggy-Instamart | Zepto |

|---|---|---|---|

| January 2024 | 40% | 32% | 28% |

| March 2023 | 40% | 36% | 24% |

| March 2022 | 32% | 52% | 15% |

Source: Statista

Consumer Behavior And Preferences

41% of consumers are satisfied with same-day delivery.

However, 24% are willing to pay extra for faster service, preferring their orders to arrive within an hour or two of placing them.

This is where quick commerce steps in, offering ultra-fast deliveries in just 15 to 20 minutes, meeting the growing demand for speed and convenience.

Source: Cmarix

46% of consumers prioritize speed when shopping online.

In addition, 74% of consumers emphasize the importance of convenience, while 48% focus on ease of use.

These shifting priorities have fueled the rise of quick commerce, as more consumers expect to receive their grocery orders within 30 minutes of placing them. This growing demand reflects a broader trend towards faster, more convenient shopping experiences.

Source: DoorDash

Impact Of Quick Commerce On Traditional Retail

In Europe, most quick commerce customers (44%) order two to four times a month.

Meanwhile, about 8% of users are heavy customers, ordering five or more times a month. Around one-third say quick commerce makes up 20% to 39% of their grocery budget.

Many customers have changed the way they shop. Half of those surveyed now get all their weekly groceries delivered through quick commerce. This shift is affecting traditional supermarkets and discount stores.

In Germany and the Netherlands, over half of quick commerce users say they’d go back to brick-and-mortar stores if fast delivery wasn’t an option. However, only 20% would turn to other e-commerce options, which usually take longer to deliver. In France, opinions are more split — 34% prefer e-food providers, while 31% would choose physical stores.

Source: Oliver Wyman.

Conclusion: Around 597.3 Million People Worldwide Are Estimated To Use Quick Commerce As Of 2024

As of 2024, the number of quick commerce users worldwide is projected to reach 597.3 million, with the U.S. market alone accounting for 56.1 million users. The industry’s impressive growth is clear, with global revenues projected to reach $170.8 billion in 2024, while the U.S. alone is set to generate $56.52 billion.

India, in particular, has seen a remarkable 280% increase in quick commerce sales over the last two years, with 1,290 dark stores currently operational in the country.

Overall, quick commerce is reshaping the retail industry, offering consumers faster, more convenient shopping experiences and continuing to evolve as a major player in the global market.