Want to grow your business? Shopify makes it easier with the Shopify Credit Card!

Designed for entrepreneurs and business owners, this card offers financial flexibility to help you manage expenses and cash flow efficiently. Instead of making large payments upfront, you can spread costs and keep your business running smoothly.

In this article, we’ll explore what the Shopify Credit Card is, who can apply, how to get started, and tips for managing it effectively.

What Is The Purpose Of Shopify Credit Cards?

Shopify Credit Cards help manage your business cash flow. It is particularly useful for covering operational costs and unexpected expenses. The Shopify Credit Card is tailored to meet the needs of growing businesses by helping financially.

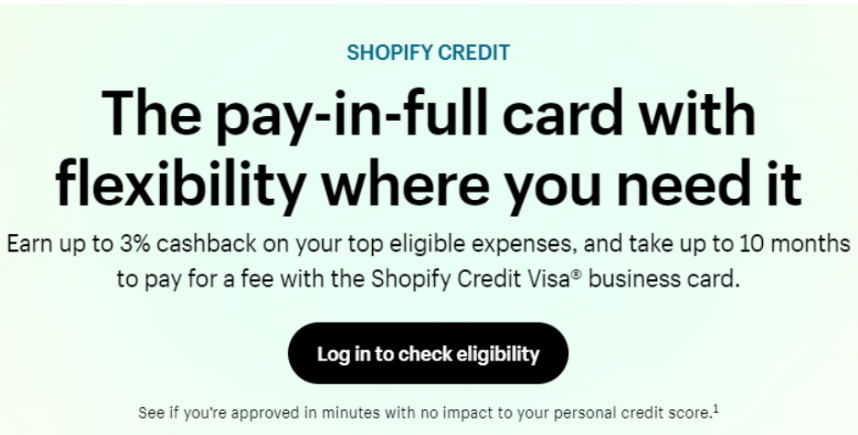

With no annual fees and the ability to earn up to 3% cashback on top spending categories like marketing and fulfillment, the card offers significant financial benefits. You can take up to 10 months to pay with the Shopify Credit Visa® business card.

Eligibility Criteria To Get A Shopify Credit Card

Now that you know the purpose of a Shopify credit card, let’s check the eligibility criteria which you need to meet the following requirements;

- Company Sales – The eligibility for a Shopify credit card is generally determined by the sales you generate on the Shopify platform.

- Identity Verification – You should have a valid United States Social Security Number (SSN) for identity. This does not affect your credit score.

- Active Shopify Account – When you sign up for the credit card, your Shopify payments must be set up or activated.

- Location – The store must be located in the United States (U.S.) or Puerto Rico. Other United States territories are not yet allowed.

- Purchased Plan – To be eligible for a Shopify credit card, you should have subscription plans. This is exceptional for Shopify Plus plan users. You can compare the pricing plans and choose the best for you and your business.

These eligibility criteria ensure that the Shopify Credit Card is accessible to a wide range of business owners with legal terms and policies.

How Do You Apply For A Shopify Credit Card?

To apply for the Credit Card, you need to go through several steps on the Shopify platform. Here’s a detailed guide to help you through the process:

Step 1: Log in to your Shopify account to access your admin dashboard.

Step 2: Go to the finance section on the dashboard to check your eligibility for the Shopify Credit Card. If you’re eligible, you will receive a Shopify credit card offer on the dashboard itself.

Step 3: Click on the offer and fill out the required details in the application form. The confirmation may take a few minutes.

Step 4: Once approved, you’ll instantly get access to the virtual Shopify Credit Card, which you can use for business expenses wherever Visa® is accepted.

Step 5: You can manage your credit card and earn up to 3% cashback on your top spend category and 1% on other eligible purchases.

To access the credit card, you should be a Shopify subscriber of any one of the plans: Basic, Shopify, or Advanced. If you haven’t purchased a plan yet, get started with the Shopify free trial offer.

Shopify allows you to pay your balance fully within 1 month, or you can opt for a flexible plan that pays from a percentage of your daily sales.

Manage Your Shopify Credit Account

After approval of the Shopify credit card, you can access your account through the Shopify admin panel. Along with a virtual card, you’ll receive a physical credit card through the mail to use for business expenses.

Here are a few ways to manage your Shopify credit account;

- Automatic Payment Options: Shopify sets up an automatic full balance payment via debit from your linked bank account on the last business day of each month’s grace period.

- Grace Period: After each statement period, you have a 1-month grace period to pay off your balance without fees. Pay in full within the given time to avoid charges.

- Flexible Payment Options: If you need more time to pay, you can opt for daily payments over a 10-month period, with a small percentage deducted from your daily sales. There’s an 11% statement fee for this period, and if it exceeds, a 2% monthly late fee is applied.

- Manual Payment: You can make manual payments at any time, choosing to pay the minimum due, the full balance, or a custom amount. Manual payments typically take 3 business days to process.

- No Annual or Foreign Transaction Fees: Shopify Credit has no annual fees or extra charges for foreign transactions, making it cost-effective for global merchants.

Benefits Of Shopify Credit Card

The Shopify Credit Card offers several benefits tailored to Shopify users, enhancing seamless business operations and providing valuable rewards. Here are some key benefits:

- Shopify allows you to apply for a credit card directly without impacting your personal credit score.

- The Shopify Credit Card typically offers cashback on purchases directly related to running your Shopify store, including advertising costs, shipping expenses, and business software (Shopify Apps or Tools).

- Shopify Credit Card holders often gain access to special discounts or rewards on Shopify services to scale businesses.

- The Shopify Credit Card has no annual fees; this allows businesses to benefit from rewards without the burden of added costs. This feature makes it more affordable and accessible, especially for small or new Shopify businesses.

- Streamline your business purchases with Shopify virtual and physical credit cards, which will benefit you and your team.

Shopify offers various benefits for businesses. According to the Shopify market share, multiple e-commerce and product-based organizations are popular beneficiaries.

Conclusion: Apply For A Shopify Credit Card To Grow Your Business

Shopify provides credit cards not only to save you hefty one-time costs but also to boost your business. It integrates to manage your business finances while you earn valuable rewards.

It’s designed to support Shopify store owners, providing flexible payment options, no annual fees, and cashback on key expenses like shipping and advertising. You access tools through Shopify credit card to optimize cash flow, save on business purchases, or streamline payment processes.

If you are looking for a hassle-free financial solution to upscale your business, a Shopify Credit Card can prove to be the best and easiest option of all.